According to a study, one out of four small businesses go through difficulties in managing their accounts receivable. However, if it gets to this stage then the business that is owed the money can suffer in the meantime. This is especially true if a business is working on a tight budget and is relying on the payment coming through. In the event of a dispute, having accurate records can back up your claims and help resolve disputes quickly and effectively. This ‘soft touch’ approach keeps communication open between you and your customer and ensures that they are aware of any upcoming payments. Remember that every touchpoint a customer has with your business (for instance, customer success) is an opportunity for you to proactively remind them.

The sales team should be an integral part of the cash collection strategy as they need to ensure that the deals they close actually turn into cash and working capital for the company. Rather, the advantage is that they are in direct contact with customers at critical collection touchpoints and this needs to be leveraged. There is a common misconception that late payments mean that a customer is a bad payer. If your business is consistently receiving late payments, it means your invoice and payment strategy are broken. Keep constant communications and offer easy online payment methods or instructions.

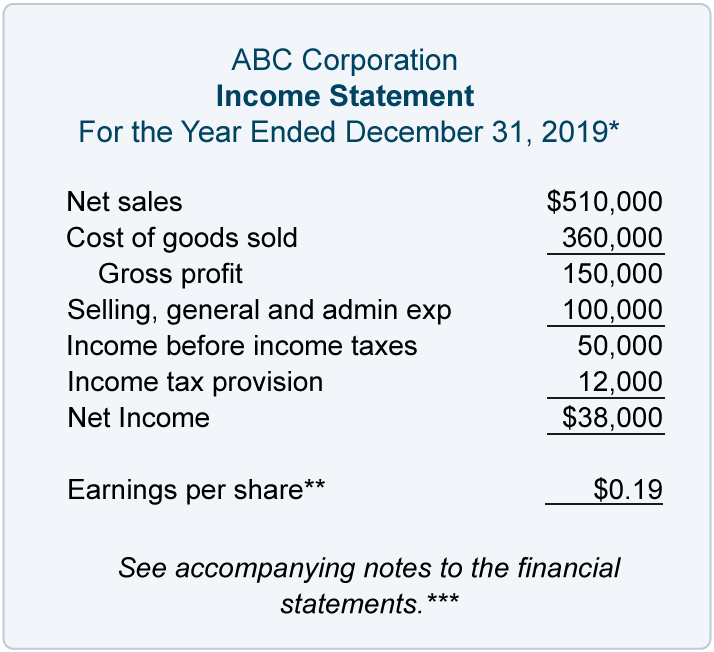

Measuring the effectiveness of your AR management

Automation allows for the instant generation and dispatch of invoices as soon as an order is confirmed via their preferred method—be it email, EDI, or even traditional mail. This not only speeds up the invoicing process but also sets the stage for quicker payments. It means that your credit policies are effective and that you’re doing a good job of vetting customers’ creditworthiness. Prompt invoicing sets the stage for all subsequent steps in the AR process. It’s the starting point for payment terms and directly impacts how quickly you can collect payments.

An invoice serves as the definitive record of a customer’s purchase, outlining how much is owed and the payment due date. The quicker you can send out the invoice, the sooner your payment terms begin, so it’s beneficial to automate this step as much as possible. It’s an asset because it has value, and it’s a current asset because it’s expected to be collected within the next 12 months. Customers at a grocery store or restaurant pay right away with cash or a card. But businesses that sell big-ticket or bulk items might not get paid for months. To see how you’re doing, compare your turnover ratio to other businesses in your industry.

- This ratio tells you how many times you’re collecting your average accounts receivable balance.

- When a customer decides to make a purchase, they’ll typically send a purchase order.

- Making this AR management process easier can improve both employee happiness and resource management internally, and customer experience on the external side.

- Equip your finance team with essential templates, Excel-based tools, and calculators designed to streamline and optimize operations.

- Often, the root cause of your collections and cash flow issues is simply poor internal processes.

It’s a good practice to initiate dispute resolution promptly if any issues arise. This helps maintain positive customer relationships and increases the chances of invoice payment. Set up a system of late payment reminders on a set schedule—for example, reminders for 1 management accounting and functions week, 2 weeks, and 3 weeks past due. It’s best to send a gentle reminder for the earliest contact and then include more formal documentation if the customer continues to ignore payment. We’ll explore Accounts Receivable and the steps in the Accounts Receivable process.

Enable easy-to-use and numerous options for stakeholders—both internal and external to interact in the way they choose to. Before delivering any goods or services, it’s essential to make sure the customer is credible. Businesses can also assess a customer’s payment history to check for credibility. But it would likely cost much more to pay for receivable management services than for your own staffer or contractor, or simply use software in-house.

For example, set up a form email to send to a is time an interval or ratio variable explanation and example client when you enter into a spreadsheet that you’ve received a payment. Another tip is if you have a customer that has accumulated multiple past due invoices, the next time you send the latest invoice, take it as an opportunity to remind them of all past due invoices. This strategy streamlines the collection process and avoids any confusion for your customers.

Days Sales Outstanding (DSO)

This way you can keep payment dates fresh in your mind and you should be able to spot if any mistakes or late payments are affecting your numbers. If this is the case, make sure that you have a wide range of payment options other than the standard ones. You can also implement what is the difference between income and profit automatic payments which helps your clients avoid recurring service charges or fees. This is why having a controlled grip on your accounts receivable management is seen as such a vital component of running a business.

Clear collection plans

It often includes invoicing, collections, payment processing, and cash application. The timing for this can vary by industry and should be in line with your company’s financial policies. For some industries, like transportation services, for example, an average days sales outstanding (DSO) of above 50 days is normal. If late payments are common in your line of work, it makes sense to wait before writing off an invoice as bad debt. They require significant manual effort that leads to errors like inaccurate data entry, delayed invoicing, miscommunications, late payments, and ineffective follow-up.

Provide contact information on customer-facing materials so customers know who to reach out to with questions. A common misconception is that the biggest accounts receivable challenges are related to late payments or high DSO. These are actually consequences of having poor AR management processes in place. Accounts receivable is an essential aspect of a business’s financial management, encompassing various components that contribute to its overall structure.